All About Personal Debt Collection

Table of ContentsSome Known Details About Business Debt Collection Some Known Facts About Business Debt Collection.The Best Strategy To Use For Business Debt CollectionThe Buzz on Personal Debt CollectionSome Known Incorrect Statements About Private Schools Debt Collection

The catch is that must the enthusiast choose less than the invoice amount, the firm's charge does not lower. As an example, allow's say you work out 25 percent of each invoice will be maintained by the collection business. If you have a billing for $1,000, the firm's fee would be $250.This is the most hands-off approach however additionally calls for that the debt collector take on the most take the chance of. When a collection firm acquisitions your financial debts, they pay you a percentage of the impressive billings.

Working with a debt collector may assist you recoup lost earnings from uncollectable loans. Yet firms have to beware when hiring a financial debt collection firm to ensure that they are properly certified, experienced and also will certainly represent your company well. Debt collection can be pricey, but the quantity you obtain from overdue invoices may deserve it

Business Debt Collection Things To Know Before You Buy

If not, get in touch with the agency and also straight negotiate such a setup. There might be a due date in the arrangement by which time you can enact a getaway clause if the company hasn't supplied.

If they do not comply with through on vital points of the agreement, you might be able to damage the contract. You can likewise merely ask the company what their termination fee is.

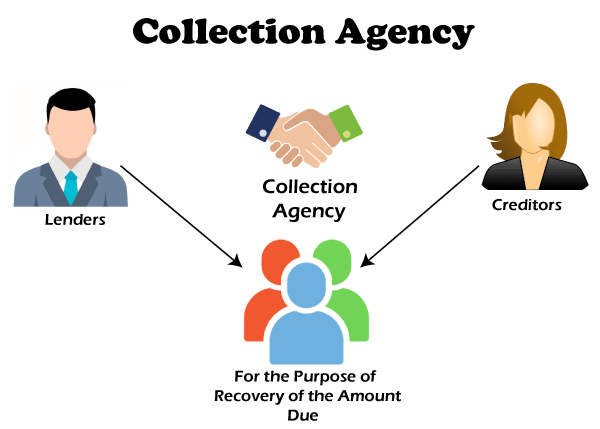

The financial debt collection industry not just offers a vital function in recovering superior financial obligations owed to creditors and also solution companies, however it likewise offers a level of confidence to lenders to make credit report available to a vast range of customers. This consists of the majority of communication and also collection tasks associated with these accounts. The condition of positioned accounts within the stemming financial institution's billing or collection systems need to suggest that the account is closed/placed.

Everything about Dental Debt Collection

Now, the creditor can cross out the financial debt as an accounts receivable possession on their annual report because the account is unlikely to be paid. The financial institution's annual report looks better, yet the creditor still keeps the ability to accumulate on an outstanding property. Debt collector service behalf of the stemming creditors as well as try to recoup unsettled balances by connecting to the customer by means of mail as well as telephone.

Agents attempt to get customers on the phone to make repayment arrangements with them, either as a More Bonuses swelling amount to resolve the account or through a collection of persisting settlements (debt collection agency). Collection firms typically obtain a compensation percentage on the amount of cash they efficiently accumulate. This compensation can vary by the age, balance, type as well as the variety of times the account has been previously worked, to name a few

Consequently, later stage collections tend to have a higher payment price, because less accounts are likely to pay. The bottom line is the lower buck. When a financial institution analyzes whether to proceed interior recovery attempts versus outsourcing collections to a 3rd party vendor, the lender has to have a strong understanding of the approximated net return of each approach and also contrast that against the price of paying commission versus the expense of running a very specialized, intensely trained group of customer assistance experts.

Private Schools Debt Collection Fundamentals Explained

Discover our collection of remedies for financial institutions as well as exactly how our 3rd party vendor management can assist you.

A roomie tells you a financial debt enthusiast called asking for you. That very pop over to these guys same financial obligation collector has actually left messages with your family members, at your workplace, as well as keeps calling you early in the morning and also late at evening.

Fortunately, there are government and Area of Columbia laws that shield consumers and also forbid financial debt collectors from using particular techniques that might be violent, unfair, or deceptive to consumers. Under these laws, there are steps that you can take to restrict a financial obligation collector's contact with you or for more information regarding the financial debt enthusiast's claim.